Realtor®.com reports that real estate markets are seeing an early start to the spring buying season this year. There is an unseasonably high demand with fewer homes for sale. The imbalance led to typical homes selling faster and pushing list prices to a record high in February. Meanwhile, higher mortgage rates squeezed buyers’ budgets.

Highlights

- The national inventory of active listings declined by 24.5% over last year, while the total inventory of unsold homes, including pending listings, declined by 15.3%. The inventory of active listings was down 62.6% compared to 2020 before the onset of the COVID-19 pandemic.

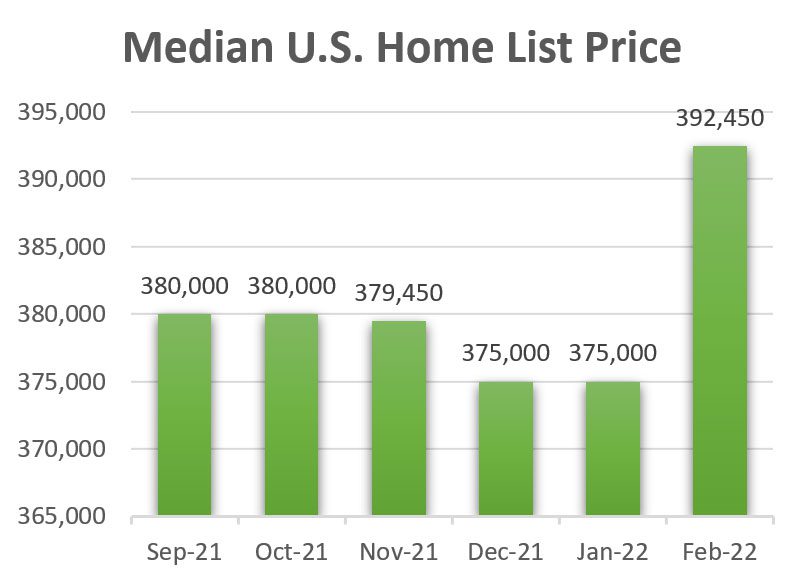

- The February national median listing price for active listings was $392,450, up 12.9% compared to last year and up 26.6% compared to February 2020.

- Nationally, the typical home spent 47 days on the market in February, down 17 days from the same time last year and down 32 days from February 2020.

Home Median Price

According to Realtor®.com, the median national home price grew to a new all-time high in February to $392,450. Median home prices rose faster than is typical for this time of year. The median price represents an annual growth rate of 12.9% and is $7,000 more than the seasonal high of $385,000 attained in July 2021.

Homes also sold more quickly than any other February in recent history. Sales in February 2022 were over a month faster (38 fewer days) than pre-pandemic years and what was typical from February 2017 to 2020. The typical home spent 47 days on the market, 17 days less than the 64 days in February 2021.

New Home Construction Declined

According to HUD, total housing starts fell 4.1% to 1.64 million units at a Seasonally Adjusted Annual Rate (SAAR) in January but were up slightly (0.8%) from 2021. Single-family housing starts declined 5.6% to 1.12 million homes (SAAR) in January from 1.18 million the previous month and were 2.4% lower than a year earlier.

Multifamily housing starts (5+ units in a structure), at 510,000 units (SAAR), declined 2.1% from 521,000 units in December but were 8.7% higher than last year.

Inventory of Homes for Sale

The inventory of existing homes for sale hit a record low of 860,000 units in January, down 2.3% from December and 16.5% (1.03 million units) from January 2021. The listed inventory represents a 1.6-month supply, a record low and down from December’s 1.7-month supply. The long-term average for months’ supply of homes on the market is 6.0 months.

The inventory of listed new homes for sale, at 406,000 units at the end of January, was up 3.0% from December and up 34.4% year-over-year. That inventory would support 6.1 months of sales at the current sales pace, up from 5.6 months in December, according to HUD.

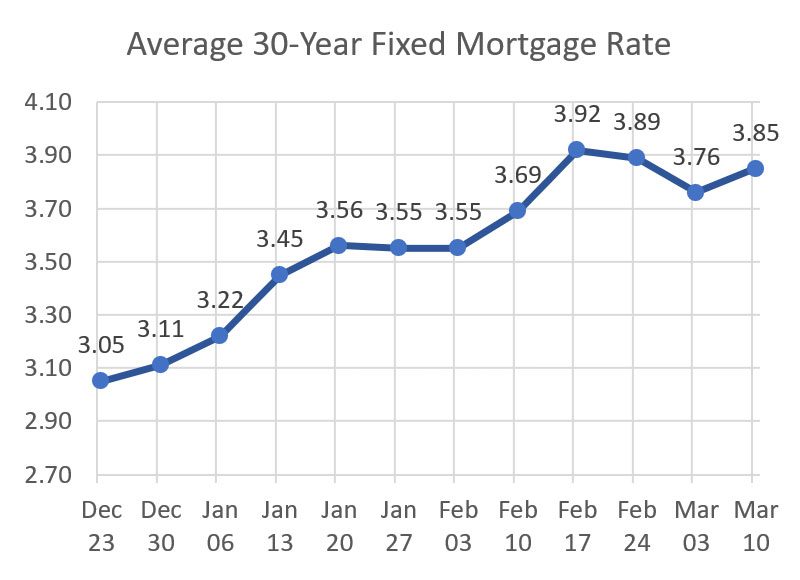

30-Year Fixed-Rate Mortgage (FRM)

The 30-year FRM has been slowly climbing after reaching an average weekly low in February of 3.55% (week ending February 3), up from a low in January of 3.22% (week ending January 6). In the last twelve weeks, the lowest rate was 3.05% in December (week ending December 23). In February 2021, the 30-year FRM was 2.73%. The record weekly low-interest rate was 2.65% the week ending January 7, 2021.

Additional Market Highlights

Redfin reports that 8.2% of U.S. homes, a record number, were valued at one million dollars or more in February. The number was almost double the pre-pandemic share of 4.8% just two years ago.

Fannie Mae Housing Forecast for February 2022 expects the median existing-home price will increase in 2022 by 11.2% over 2021 which is a slower pace than the first two months of 2022. Fannie Mae thinks it will be 2023 before homebuyers find relief.

Sources:

February 2022 Monthly Housing Market Trends Report (Realtor.com)

Housing Market Indicators (HUD)

30-Year Fixed-Rate Mortgage Average in the United States (Federal Reserve/Freddie Mac)

A Record 8% of U.S. Homes Are Worth At Least $1 Million (Redfin)

Housing Forecast: February 2022 (Fannie Mae)

© 2022 xpertRealtyMarketing. Sign up to have real estate articles delivered to your website.